IHT Myths

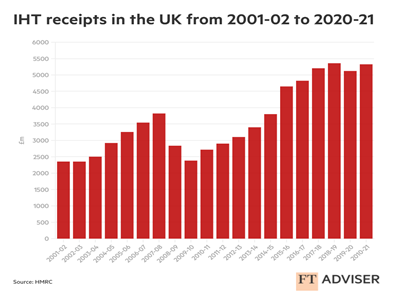

The last 20 years has seen a great increase in property wealth. This has accompanied a large increase in the amount of IHT receipts to HMRC, as shown in the chart below. Despite this, not enough people are receiving professional advice and are instead leaning on common inheritance tax myths. Discussing their circumstances with a professional and taking simple actions now could alleviate the burden on the next generations.

We aim to quell some common inheritance tax myths and offer useful advice:

1. “IHT affects only the ultra wealthy”

Probably true in decades gone by. However, with the increase in property prices in recent years, this has pushed some estates into IHT territory. That said, the government have introduced legislation that offers a further nil rate band allowance (a tranche of assets charged at 0% for IHT) set against the value of an individual’s main residence, up to £175,000. For a couple this means that they could have up to £1million of their estate charged at 0%; comprised of £325,000 nil rate band per spouse and £175,000 residence nil rate band per spouse.

2. “I give my son and daughter £3,000 pa each and I know this is tax free”

Gifts of £3,000 pa are one of the exempt allowances available, however, this refers to £3,000 pa per donor not per recipient. In this case, one gift will be exempt from IHT and the other will fall into the 7 year rule.

3. “I can gift my house to my kids, live in it and it will be outside of my estate for IHT”

This is one we hear all the time and if it were that simple, everyone would be doing it. This gift would fall foul of the gift with reservation rules, that are in force to prevent someone making a gift to mitigate IHT, but then having full use of said asset.

4. “ISAs are IHT exempt”

ISAs are tax efficient investments and savings. Although they are efficient against income tax and capital gains tax, they do fall into one’s estate when calculating IHT. Therefore ISAs are not exempt against IHT. In some circumstances, underlying investments of an ISA may qualify for Business Property Relief and so will be allowable against IHT. However, these investments are very high risk and you should seek professional advice before investing in these assets.

5. “My pension is included in my will”

Most pension contracts fall under a global trust arrangements and so will be outside of one’s estate for IHT. Most arrangements will ask the holder to nominate a beneficiary, via an Expression of wish, in the event of their death. This nomination is not binding on the Trustees of the pension scheme. As such they will also take into account how assets are left in a will and also any dependants’ needs. That said, it is not necessary to detail pension provision specifically in a will as these are dealt with by the Expression of wish.

It is not always the case that pension policies are written in the manner detailed above. Some historical contracts are written under different legislation. You should seek advice on the particular death benefits of any contracts you hold to ensure they meet your needs.

6. “I don’t want to make a gift to my children as they will be taxed on receipt of the gift”

On making outright gifts in excess of any exempt allowances (such as the £3,000 pa allowance referred to previously), these will fall under the 7 year rule. As long as the donor lives for 7 years from making the gift, they will not be within one’s estate for IHT purposes. The rules are not that clear cut and previous outright gifts and gifts into Trust should be carefully considered. Equally on gifting assets, there may be a liability on the donor to Capital Gains tax. The recipient of the gift is not required to pay income tax, capital gains tax or IHT on the gift itself.

IHT mitigation is a very complex subject. It’s one which benefits from professional advice with a financial adviser and a solicitor. Knowing whether your estate would suffer a tax charge is just the first step.

The late Lord Roy Jenkins of Hillhead in a House of Commons debate, 19 March 1986, famously said ‘Inheritance Tax; – it is, broadly speaking; a voluntary levy paid by those who distrust their heirs more than they dislike the Inland Revenue.’

If there are any more inheritance tax myths you’d like us to bust, or if you want advice for your future, please get in touch.

Categories: Professional Connection Support, Updates